Client expectations changed, so your approach should also evolve…

The fund company Vanguard1 recently published the results of a study on the value-added of advisors – but from the clients’ perspective. Mind you, although the study focuses on the financial services industry, it’s applicable to all advisory industries!

It’s no longer enough to provide our “knowledge”, our “expertise”, today’s clients are looking for human connections (read or re-read my article on the ‘hello@mail’ and the one on the conversation you should have with your clients.)

So here are some of the conclusions of the study:

- Advice adds even more value. Investors believe that advice provides significantly more additional value to the portfolio than if they managed their investments themselves (five percent for human advice and three percent for robo-advisors).Conclusion: clients value the advice of their professionals; many have tried the DYI (do-it-yourself) route and have tried to do everything themselves. There’s a return of the pendulum and a desire to be well guided (this applies to so many industries!!).

- The preference for financial advisors persists. Over 90% of clients who use human advisors say they would not consider switching to a digital service and 88% of clients who use robo-advisors would consider switching to a human advisor.Conclusion: the age of technology is reaching its limits. People are getting tired of bots, chatbots, automation, millions of options to select when calling…they want to talk to a human (this applies to so many industries!!)!

- Clients prefer the emotional support of human advisors. Investors who do business with human advisors feel they are closer to their financial goals by as much as $160,000. Three times as many of them say they have greater peace of mind with a human advisor than if they were managing their investments themselves.Conclusion: A big part of our role in an advisory business is managing emotions, easing our clients’ fears, helping them get to the important conversations of their dreams – in short, to stop limiting or sabotaging themselves! (this, again, applies to so many industries!!)

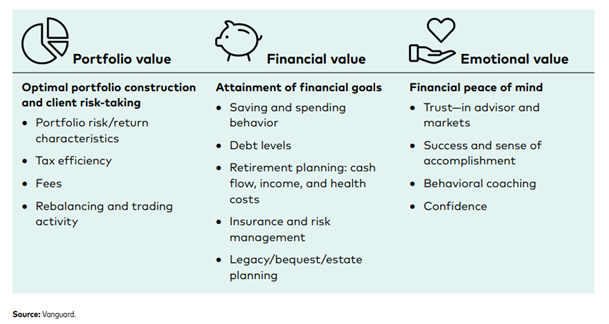

Based on another research study by Anna Madamba, Ph.D., Cynthia A. Pagliaro and Stephen P. Utkus, they developed a model based on the value of advice (which they call: Value-of-advice framework), this approach is centred on three pillars:

Portfolio value is the result of building a well-diversified portfolio adapted to an investor’s needs. Financial value refers to planning to achieve desired financial goals. Emotional value embodies the idea of peace of mind.

We’ve entered a different era and the changes in client behaviours over the last two years, the third pillar is – the emotional value – is by far the most important, yet… the least present in our conversations.

The third pillar is the one that allows you to stand out from the crowd. This is what clients are seeking for.

Yes, your role is to be a guide for your clients – I often have clients tell me that they feel like their clients’ shrink! But the reality is that when you dare to create what I call “second-level conversations”, focus less on doing, your emphasis is on being more.

When you develop the art of asking excellent questions, understand the emotional vocabulary of the words you use, understand the different axes of transformation, you’re able to help your clients at a much deeper level.

You help them to unravel their goals, their projects, their dreams – which often have been forgotten or put aside out of fear or simply because life moves fast and we forget…

Emotional value is the greatest value you can embody. The “doing”, hence the plan, the strategy are tools, means to get to the destination they aim at.

In the end, the work you do and the work I do are the same – we take different paths, but we help our clients achieve their dreams.

For those who are ready to add the third pillar to their conversations with their clients…

I’m hosting a workshop on the psychology of communication, on how to verbalise emotional value – we’ll discuss how to create deep conversations; what words, sentences, questions to use; how to verbalise the value and impact of your work so that your words ‘connect’ with your clients’ hearts. This is not a typical free webinar, it is a paid workshop for those who are ready to make a profound difference in the lives of their clients.

Click here for all the details (in French)

All the entrepreneurs and leaders I know have a strong mastery of the first two pillars, the third one requires new skills that need to be developed. The beauty is that they can be developed.

Will you answer your client’s call of emotional guidance? That’s the question.

I am always happy to read your comments. You can always reach me here and keep in touch via social media: LinkedIn, Facebook, YouTube and now Instagram.

If you enjoyed this article, you will love:

Titled Quantifying the investor’s view on the value of human and robo-advice (Quantifying investors’ views on the value of human and digital advice), the study looked at the valuation of financial advice and the value of advice received by clients.